Loan Ontario: Deciphering the Refine of Protecting Financial Aid

Loan Ontario: Deciphering the Refine of Protecting Financial Aid

Blog Article

Empower Your Dreams With Hassle-free Car Loan Solutions That Benefit You

Practical funding solutions offer a lifeline for those seeking to pursue their goals without hold-up, offering a range of options customized to specific demands and scenarios. Allow's check out the different elements of convenient car loan services and exactly how they can equip you to get to brand-new elevations.

Sorts Of Convenient Loans

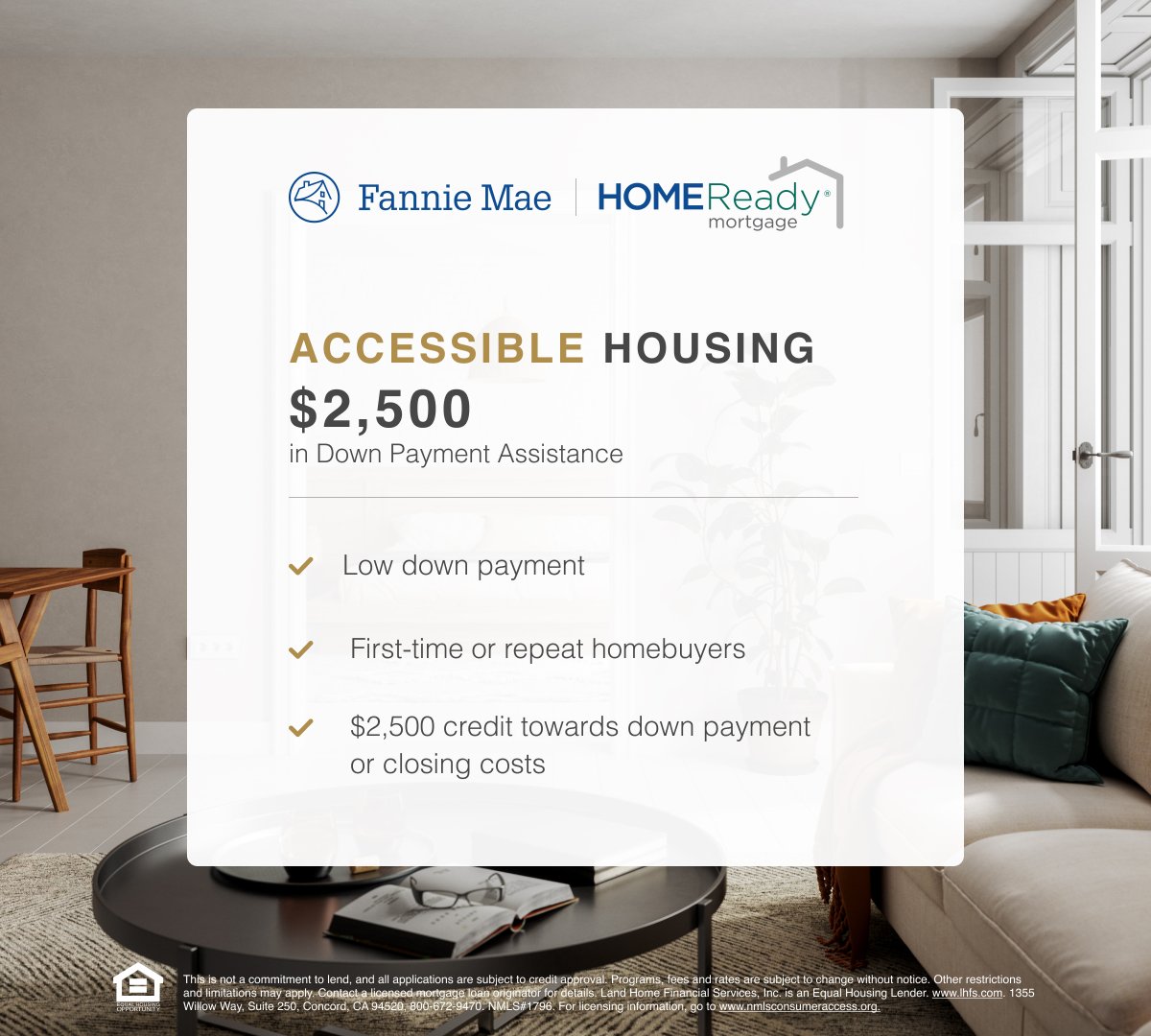

What are the various sorts of convenient loans readily available to match various economic needs and ambitions? When checking out practical financing options, people can pick from a range of funding kinds customized to their certain requirements. Personal lendings are a prominent selection for customers looking for flexibility in utilizing the funds for numerous purposes, such as financial obligation combination, home improvements, or unanticipated expenditures. These lendings generally have actually taken care of rates of interest and foreseeable monthly repayments, making budgeting much easier.

For those seeking to fund a particular purchase, such as a vehicle or home, vehicle finances and home loans provide tailored financing solutions with affordable rate of interest based on the possession being financed. In addition, consumers can choose student financings to cover academic expenditures, with adaptable payment terms and desirable rate of interest.

Furthermore, people with a strong credit background may get low-interest price lendings, while those with less-than-perfect credit history can check out options like payday advance or protected finances that require collateral. By recognizing the various types of convenient financings offered, customers can make informed choices that align with their monetary objectives.

Qualification Needs

A great credit score is typically essential in securing desirable funding terms, as it demonstrates a background of responsible financial habits. A reduced proportion suggests a much healthier financial placement and a greater possibility of loan authorization. Meeting these qualification requirements is vital for accessing convenient lending services that straighten with your monetary needs and objectives.

Application Process

Upon completing the eligibility assessment and meeting the needed criteria, applicants can continue with the streamlined application process for accessing practical funding services customized to their financial goals. The application process is designed to be simple and efficient, allowing people to apply for the desired lending with convenience.

As soon as the initial information is sent, candidates might require to specify the funding amount, payment terms, and function of the funding. Some lending institutions offer on the internet application portals, making it possible for applicants to conveniently complete types and upload needed documents from the convenience of their homes. After the submission, the lending institution will certainly assess the application and perform an extensive examination to figure out the candidate's eligibility and the loan terms that straighten with their financial goals. Upon approval, the funds are paid out immediately, equipping individuals to seek their dreams and achieve their objectives with the support of the convenient financing solutions readily available to them.

Car Loan Payment Options

Benefits of Convenient Loans

Among the essential benefits of hassle-free fundings depends on their capability to streamline the loaning procedure for individuals looking for to accomplish their monetary goals successfully. These finances supply a convenient and quick application procedure, frequently allowing consumers to use online without the demand for comprehensive documentation or multiple in-person sees to a bank. This structured technique best site conserves useful effort and time for customers that require funds immediately.

Moreover, convenient lendings generally have flexible qualification standards, making them accessible to a broader array of people, including those with varying credit rating. When they require them most (personal loans ontario)., this inclusivity ensures that more individuals can profit from these economic items.

Convenient financings additionally frequently included affordable rate of interest and positive terms, permitting customers to manage their repayments successfully. In addition, some loan providers supply customized funding personal loans ontario choices tailored to the particular requirements and conditions of the debtor, further enhancing the general convenience and viability of the loan. In general, the benefits of convenient finances empower people to satisfy their financial aspirations with simplicity and effectiveness.

Final Thought

Finally, convenient finances use a selection of choices to equip people to accomplish their desires. With very little eligibility demands and a simple application process, these finances provide versatility and simplicity. The repayment options satisfy private demands, ensuring a manageable monetary commitment. In general, hassle-free financings provide benefits that can assist individuals browse their economic goals with self-confidence and convenience.

When discovering convenient financing options, people can pick from a selection of loan kinds tailored to their particular requirements.As soon as the first info is submitted, candidates might require to define the funding quantity, repayment terms, and objective of the finance.After successfully protecting the wanted car loan and getting started on the trip go to my site towards understanding their financial goals, customers are presented with a range of structured loan payment alternatives to effectively handle their monetary commitments. Additionally, some loan providers offer tailored loan alternatives customized to the particular requirements and circumstances of the debtor, further boosting the overall comfort and viability of the car loan. On the whole, practical financings use benefits that can assist individuals browse their monetary objectives with self-confidence and benefit.

Report this page